SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

Northern Lights Fund Trust III

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person (s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Persimmon Long/Short Fund

a series of

Northern Lights Fund Trust III

4221 North 203rd Street, Suite 100

Elkhorn, NE 68022

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held [MEETING DATE],October 15, 2021

Dear Shareholders:

The Board of Trustees of the Northern Lights Fund Trust III, an open-end management investment company organized as a Delaware statutory trust, has called a special meeting of the shareholders of Persimmon Long/Short Fund (the “Fund”), to be held at the offices of the Trust’s counsel, Thompson Hine LLP, 41 S. High Street, Suite 1700, Columbus, OH 43215 on [MEETING DATE],October 15, 2021 at 10:00 a.m., Eastern time, for the following purposes:

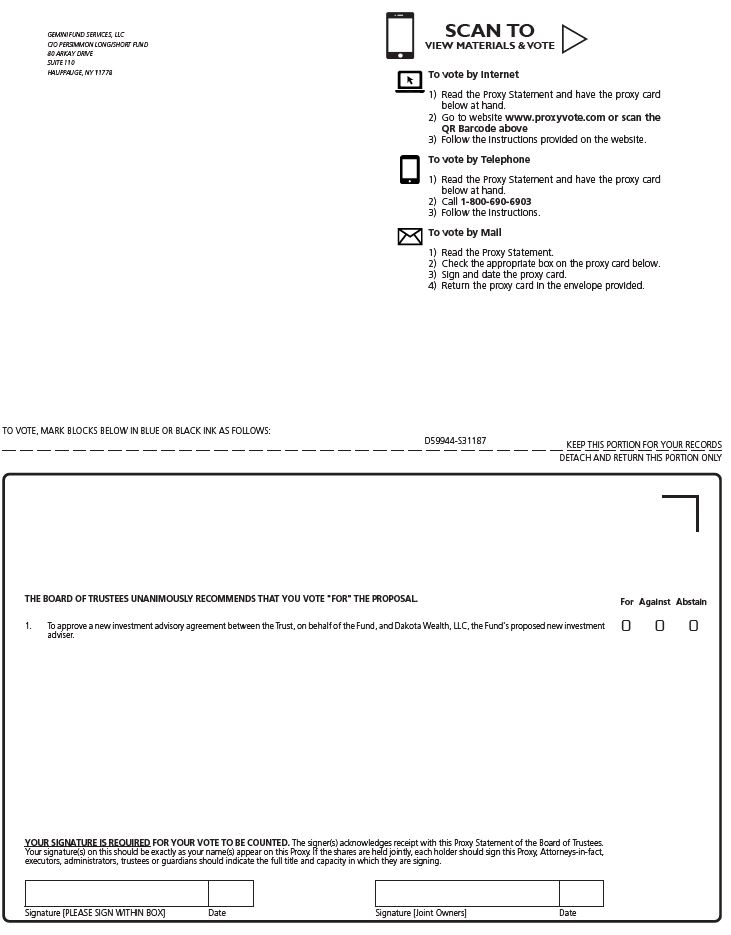

| 1. | To approve a new investment advisory agreement with Dakota Wealth, LLC, the Fund’s proposed new investment adviser. There will be no changes with respect to the Fund’s investment strategy and investment objective as a result of the new investment adviser. |

| 2. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Shareholders of record at the close of business on [RECORD DATE],September 3, 2021 are entitled to notice of, and to vote at, the special meeting and any adjournments or postponements thereof. The Notice of Meeting, Proxy Statement, and accompanying form of proxy will be mailed to shareholders on or about [MAILING DATE],September 17, 2021.

By Order of the Board of Trustees

__________________________________/s/ Eric Kane__________________________________

Eric Kane, Esq., Secretary

[MAILING DATE],September 17, 2021

| 1 |

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON [MEETING DATE],OCTOBER 15, 2021

A copy of the Notice of Shareholder Meeting, the Proxy Statement (including the proposed Investment Advisory Agreement) and Proxy Voting Ballot are available at www.proxyvote.com[INSERT WEBSITE]

YOUR VOTE IS IMPORTANT

To assure your representation at the meeting, please complete the enclosed proxy and return it promptly in the accompanying envelope or by calling the number listed on your proxy card whether or not you expect to be present at the meeting. If you attend the meeting, you may revoke your proxy and vote your shares in person.

| 2 |

Persimmon Long/Short Fund

a series of

Northern Lights Fund Trust III

with its principal offices at

4221 North 203rd Street, Suite 100

Elkhorn, Nebraska 68022

____________

PROXY STATEMENT

____________

SPECIAL MEETING OF SHAREHOLDERS

To Be Held [MEETING DATE],October 15, 2021

____________

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of the Northern Lights Fund Trust III (the “Trust”) on behalf of Persimmon Long/Short Fund (the “Fund”), for use at a Special Meeting of Shareholders of the Trust (the “Meeting”) to be held at the offices of the Trust’s counsel, Thompson Hine LLP, 41 S. High Street, Suite 1700, Columbus, OH 43215 on [MEETING DATE],October 15, 2021 at 10:00 a.m. Eastern time, and at any and all adjournments thereof. The Notice of Meeting, Proxy Statement, and accompanying form of proxy will be mailed to shareholders on or about [MAILING DATE],September 17, 2021.

The Meeting has been called by the Board for the following purposes:

Only shareholders of record at the close of business on [RECORD DATE],September 3, 2021 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any adjournments or postponements thereof.

A copy of the Fund’s most recent annual report, including financial statements and schedules, is available at no charge by visiting www.persimmonfunds.com, sending a written request to the Fund, 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022 or by calling 1-855-233-8300.

| 1 |

PROPOSAL I

APPROVAL OF A NEW INVESTMENT ADVISORY AGREEMENT BETWEEN

THE TRUST AND DAKOTA WEALTH, LLC

The Board is requesting that shareholders approve the New Advisory Agreement between the Trust, on behalf of the Fund, and Dakota Wealth. Approval of the New Advisory Agreement will not change the Fund’s investment strategy, investment objective, advisory fee, expense limitations or portfolio managers. No changes to other service providers or the operations of the Trust are proposed, planned or anticipated at this time.

Overview and Background

The primary purpose of this proposal is to enable Dakota Wealth to continue to serve as the investment adviser to the Fund. Dakota Wealth is a Florida limited liability company with its principal place of business at 11376 N. Jog Road, Suite 1010, Palm Beach Gardens, FL 33418-1752. On July 1, 2021, Dakota Wealth acquired Persimmon Capital Management L.P. (“PCM”), the former investment adviser to the Fund (the “Transaction”)

Up until the Transaction, PCM had served as the Fund’s investment adviser since the Fund’s inception on December 31, 2012 pursuant to an advisory agreement approved by the Board on November 29, 2012 and last renewed by the Board on November 23-24, 2020 (the “Previous Advisory Agreement”). As part of the Transaction, the PCM name was retired. Dakota Wealth retained all of PCM’s key personnel serving the Fund. The Transaction did not result in any change in the Fund’s investment strategies and objectives and no changes are expected to be made to the persons responsible for the day-to-day management of the Fund, or to any existing service provider to the Fund at this time.

As required by the Investment Company Act of 1940, as amended (the “1940 Act”), the Previous Advisory Agreement provided for its automatic termination in the event of an assignment. Under the 1940 Act, the acquisition of PCM by Dakota Wealth is deemed a change of control of PCM. This change of control is treated as an assignment under the 1940 Act and thereby terminated the Previous Advisory Agreement.

At a meeting on June 17, 2021 conducted via videoconference pursuant to SEC Release Order No. 33897 (the “Board Meeting”), the Trustees approved the New Advisory Agreement subject to shareholder approval. The 1940 Act requires that the New Advisory Agreement be approved by a vote of a “majority” of the outstanding shares of the Fund as that term is defined in the 1940 Act. Therefore, shareholders are being asked to approve the proposed New Advisory Agreement. At the Board Meeting, the Board also approved an interim advisory agreement between the Trust, on behalf of the Fund, and Dakota Wealth (the “Interim Advisory Agreement”)

The Interim Advisory Agreement allows Dakota wealth to manage the Fund while the Board solicits shareholder approval of the New Advisory Agreement. Dakota Wealth began managing the Fund pursuant to the Interim Advisory Agreement upon the close of the Transaction on July 1, 2021. The Interim Advisory Agreement is effective until the earlier of 150 days from that date or the date the New Advisory Agreement is approved.

The terms of the Interim Advisory Agreement and the New Advisory Agreement are substantially the same as the Previous Advisory Agreement, except for: (i) the date of its execution, effectiveness, and termination are changed, (ii) the Interim Advisory Agreement and New Advisory Agreement names Dakota Wealth rather than PCM as the Fund’s investment adviser, and (iii) the fees earned by Dakota Wealth under

the Interim Advisory Agreement will be held in a separate escrow account pending shareholder approval of the New Advisory Agreement. The effective date of the New Advisory Agreement will be the date shareholders of the Fund approve the New Advisory Agreement. Upon approval of the New Advisory Agreement by the Fund’s shareholders, the escrowed management fees will be paid to Dakota Wealth. If a majority of the Fund’s shareholders do not approve the New Advisory Agreement, then Dakota Wealth will be paid the lesser of (i) its costs, plus interest, incurred in managing the Fund under the Interim Advisory Agreement, or (ii) the total amount in the escrow agreement.

PCM had contractually agreed to reduce its fees and to reimburse expenses, at least until January 31, 2022, to ensure that total annual fund operating expenses after fee waiver and/or reimbursement (excluding (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions, (iii) acquired fund fees and expenses; (iv) borrowing costs (such as interest and dividend expense on securities sold short); (v) taxes; and (vi) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees, contractual indemnification of Fund service providers (other than the adviser))) would not exceed 1.99% of average daily net assets attributable to Class I shares (the “expense limitation”). PCM could seek reimbursement only for fees waived or expenses paid by it during the prior three years; provided, however, that such fees and expenses could only be reimbursed to the extent they were waived or paid after the date of the waiver agreement (or any similar agreement). Reimbursements could only be sought if total expenses remained below the expense limitation in place at the time of the reimbursement and at the time of waiver. Dakota Wealth has agreed to the same expense limitation under the same terms as PCM. The Board may terminate the expense limitation at any time.

Dakota Wealth is a registered investment adviser that provides investment management, wealth and estate planning, and full-service tax planning to high net worth individuals, families and institutions. Dakota Wealth draws on its own independent research and analytical framework to construct portfolios and provide comprehensive services for investors using a team of dedicated, skilled professionals with a deep well of experience. If shareholders approve the New Advisory Agreement, the same team investment team from PCM who previously serviced the Fund as portfolio managers will continue to serve as portfolio managers for the Fund under the Dakota Wealth name and with Dakota Wealth’s resources. The portfolio managers will continue the same investment strategy currently pursued by the Fund with no change to the advisory fee paid by shareholders or the expense limitations of the Fund.

| 3 |

The Advisory Agreements

Both the Previous Advisory Agreement and New Advisory Agreement (collectively, the “Advisory Agreements”) provide that the investment adviser will, among other things, (i) continuously furnish an investment program for the Fund in a manner consistent with the Fund’s investment objectives, policies and restrictions, (ii) determine securities to be purchased, sold, retained or lent by the Fund and (iii) implement those decisions, including the selection of entities with or through which such purchases, sales or loans are to be effected. The table below reflects the advisory fee under each of the Advisory Agreements as a percentage of the Fund’s average daily net assets:

Advisory Fee Under the Previous Advisory Agreement | Advisory Fee Under the New Advisory Agreement |

1.25% |

1.25% |

Pursuant to the Advisory Agreements, from this advisory fee, the adviser pays all of the Fund’s operating expenses, excluding brokerage fees and commissions, indirect costs of investing in other investment companies, taxes, borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short), and such extraordinary or non-recurring expenses as may arise, including litigation to which the Fund may be a party and indemnification of the Trust’s Trustees and officers with respect thereto. The Fund will also pay expenses authorized pursuant to Rule 12b-1 under the 1940 Act which are not expected to change. The Fund currently offers only Class I shares which are not subject to any Rule 12b-1 fees. For the fiscal year ended September 30, 2020, the Fund paid PCM an advisory fee computed and accrued daily and paid monthly, at an annual rate of 1.75% of the Fund’s average daily net assets. For the fiscal year ended September 30, 2020, PCM received $544,330 in advisory fees and recaptured $40,903 in previously waived fees or expenses. The amount available for recapture by PCM under its expense limitation arrangement is $55,016. Any recoupment of waived fees or reimbursement of expenses under the Previous Advisory Agreement can only occur for fees waived or expenses paid by PCM prior to the Transaction.

The New Advisory Agreement, like the Previous Advisory Agreement, will automatically terminate on assignment and is terminable on 60 days’ notice by the Board. In addition, like the Previous Advisory Agreement, the New Advisory Agreement may be terminated by the adviser on 60 days’ notice to the Board. Both Advisory Agreements provide that the adviser shall not be subject to any liability in connection with the performance of its services thereunder in the absence of willful misfeasance, bad faith, gross negligence or reckless disregard of its obligations and duties.

At the Board Meeting, the Board noted the similarities between the Advisory Agreements and the investment process. The Board discussed that the advisory fee under the New Advisory Agreement would be the same as the advisory fee under the Previous Advisory Agreement. The Board considered that, other

than the name of the adviser, effective dates and termination dates, the terms of the Advisory Agreements were substantially the same. The Board also considered that the investment strategy, investment objective and investment restrictions would also remain the same under the New Advisory Agreement. Therefore, after review of the factors required in approving an investment adviser, which are described below in “Evaluation by the Board of Trustees”, the Board determined to approve Dakota Wealth as an investment adviser to the Fund.

Subject to shareholder approval, the Trust will enter into the New Advisory Agreement with Dakota Wealth. The New Advisory Agreement will continue in effect for an initial period of two years from the date it is approved by shareholders.

Each of the Advisory Agreements provides that it will continue in effect from year to year after its current period ends, but only so long as its continuance is approved at least annually by (i) the Board or (ii) a vote of a majority of the outstanding voting securities of the Fund, provided that in either event its continuance is also approved by a majority of the independent Trustees of the Board pursuant to the requirements of the 1940 Act or the rules, guidance or exemptive relief thereunder.

If the New Advisory Agreement with Dakota Wealth is not approved by shareholders, the Interim Advisory Agreement with Dakota Wealth will continue until its expiration while the Board and Dakota Wealth consider other options, including a new or modified request for shareholder approval of a new investment advisory agreement.

The description in this Proxy Statement of the New Advisory Agreement is only a summary. The New Advisory Agreement is attached as Exhibit A. You should read the New Advisory Agreement.

Information Concerning Dakota Wealth

��

Dakota Wealth is a Florida limited liability company with its principal office located at 11376 N. Jog Road, Suite 1010, Palm Beach Gardens, FL 33418-1752. The names, addresses and principal occupations of the principal executive officers of Dakota Wealth as of the date of this Proxy Statement are set forth below:

| Name and Address* | Principal Occupation: |

| Peter J. Raimondi | Chief Executive Officer |

| Kayla M. Berg | Chief Compliance Officer |

| Carina S. Diamond | Chief Experience Officer |

| Gregory S. Horn | Chief Development Officer |

| Bryan P. Keller | Chief Strategic Officer |

| Timothy Melly | Director, Portfolio Manager |

| Michael Reed | Chief Operating Officer |

*Each officer’s address is in care of Dakota Wealth, LLC, 11376 N. Jog Road, Suite 1010, Palm Beach Gardens, FL 33418-1752.

| 5 |

Section 15(f) of the 1940 Act

The parties to the Transaction intend to rely on Section 15(f) of the 1940 Act, which provides a non-exclusive safe harbor whereby an owner of an investment adviser to an investment company may receive payment or benefit in connection with the sale of an interest in the investment adviser if two conditions are satisfied. The first condition is that during the three-year period following the Transaction, at least 75% of the investment company’s board must not be “interested persons” (as defined in the 1940 Act) of the

investment adviser or its predecessor. The Board currently meets this requirement as all of the Trustees are independent and will continue to do so for the periods required. Second, no “unfair burden” can be imposed on the investment company as a result of the Transaction. An “unfair burden” includes: any arrangement during the two-year period after the Transaction where the investment adviser (or predecessor or successor adviser), or any of its “interested persons” (as defined in the 1940 Act), receives or is entitled to receive any compensation, directly or indirectly, (i) from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the investment company (other than bona fide ordinary compensation as principal underwriter for the investment company), or (ii) from the investment company or its shareholders (other than fees for bona fide investment advisory or other services). The Board determined that there was no “unfair burden” imposed as a result of the Transaction, and the Trust will ensure that this condition will continue to be satisfied for the required time period.

Evaluation by the Board of Trustees

At the Board Meeting, the Board considered the approval of the Interim Advisory Agreement and New Advisory Agreement with Dakota Wealth. The Board relied on the advice of independent legal counsel and its own business judgment in determining the material factors to be considered in evaluating the Interim Advisory Agreement and the New Advisory Agreement and the weight to be given to each factor. The conclusions reached by the Board were based on an evaluation of all of the information provided and were not the result of any single factor. Moreover, each Board member may have afforded different weight to the various factors in reaching conclusions with respect to the Interim Advisory Agreement and the New Advisory Agreement.

Nature, Extent and Quality of Service. The Board discussed that Dakota Wealth was founded in 2018 as the culmination of several wealth management firms, the oldest of which began in 1986. The Board noted that after the anticipated acquisition, Dakota Wealth would manage over $1.6 billion in assets and provide investment management, estate planning and tax services while creating customized portfolios for its clients. The Board noted its familiarity and experience with the key investment personnel that would be responsible for managing Persimmon and recalled their experience and backgrounds. The Board observed that Dakota Wealth would add a co-Chief Compliance Officer to assist the current Chief Compliance Officer. The Board discussed that the Fund’s investment objective and strategies would remain unchanged and that Dakota Wealth would continue the same investment processes as the existing adviser. The Board remarked that Dakota Wealth would continue monitoring compliance with the Fund’s investment limitations by reviewing portfolio reports and utilizing pre- and post-trade checklists. The Board mentioned that Dakota Wealth

| 6 |

would continue selecting broker-dealers that meet its best execution criteria for providing quality service at a reasonable fee and with reduced transaction and margin borrowing costs. The Board recognized that Dakota Wealth reported no material compliance or litigation matters in the past 36 months. The Board discussed that the acquisition of the Fund’s current adviser by Dakota Wealth was part of a long-term succession plan that could benefit shareholders due to Dakota Wealth’s strong financial position and available resources to service and grow the Fund’s assets. The Board concluded that it could expect Dakota Wealth to provide a high level of quality service to the Fund for the benefit of the Fund’s shareholders.

Performance. The Board noted that Fund changed investment strategies in December 2019 and, for that reason, focused on the Fund’s performance for the 1-year period. The Board noted that the Fund’s performance slightly trailed its Morningstar category but was on par with its peer group. The Board noted that the Fund’s performance had significantly improved on an absolute and relative basis over the 1-year period compared to the 3-year, 5-year and since inception periods. The Board noted that the investment team currently managing the Fund would continue managing the Fund at Dakota Wealth. The Board determined that Dakota Wealth should be permitted to manage the Fund over a full-market cycle.

| Annualized Performance Returns for the periods ended 4/30/21 | 1-year | 3-year | 5-year | Since Inception (12/31/12) |

| Persimmon Long/Short Fund | 20.64% | 5.27% | 4.85% | 4.27% |

| Peer Group of funds selected by Broadridge (median) | 20.64% | 4.95% | 5.53% | 6.15% |

| Long-Short Equity Morningstar Category (median) | 22.91% | 6.87% | 7.59% | 6.85% |

| S&P 500 Total Return Index | 45.98% | 18.67% | 17.42% | 16.08% |

Fees and Expenses. The Board remarked that the advisory fee for the Fund was slightly higher than the averages and medians of its Morningstar category and peer group but well below the highs of each. The Board noted that the Fund’s net expense ratio was the high of its Morningstar category and peer group. The Board discussed that the advisory fee for the Fund was reduced from 1.75% to 1.25% in December 2020 and that the reduction in advisory fee was not fully reflected in its annualized net expense ratio. The Board observed that Dakota Wealth proposed no changes to the Fund’s current advisory fee or expense limitations. The Board determined that Dakota Wealth’s advisory fee for the Fund would not be unreasonable.

| As of 4/30/21 | Net Expense Ratio | Advisory Fee | |

| Persimmon Long/Short Fund | 2.49% | 1.25% | |

Peer Group selected by Broadridge | High | 2.49% | 1.75% |

| Median | 1.51% | 1.20% | |

| Average | 1.48% | 1.22% | |

| Low | 0.55% | 0.70% | |

Long-Short Equity Morningstar Category | High | 2.49% | 2.50% |

| Median | 1.44% | 1.22% | |

| Average | 1.47% | 1.23% | |

| Low | 0.55% | 0.35% | |

Economies of Scale. The Board discussed the size of the Fund and its prospects for growth, concluding the Fund had not achieved meaningful economies necessitating the establishment of breakpoints. The Board noted Dakota Wealth was willing to discuss the implementation of breakpoints as the assets of the Fund grew and Dakota Wealth achieved material economies of scale related to its management of the Fund. The Board agreed to monitor and revisit this issue at the appropriate time.

Profitability. The Board reviewed the profitability analysis provided by Dakota Wealth and noted that Dakota Wealth anticipated realizing a reasonable profit during the first two years of the advisory agreement. The Board concluded that excessive profitability was not an issue for Dakota Wealth.

Conclusion. Having requested and received such information from Dakota Wealth as the Board believed to be reasonably necessary to evaluate the terms of the Interim Advisory Agreement and New Advisory Agreement, and as assisted by the advice of independent counsel, the Board concluded that the proposed advisory fee was not unreasonable and that approval of the Interim Advisory Agreement and New Advisory Agreement was in the best interests of the Trust and the shareholders of the Fund.

The Board of Trustees of the Trust, consisting entirely of Independent Trustees, recommends that shareholders of the Fund vote “FOR” approval of the New Advisory Agreement.

| 8 |

OTHER INFORMATION

The Fund is a diversified series of the Northern Lights Fund Trust III, an open-end investment management company organized as a Delaware statutory trust and formed by an Agreement and Declaration of Trust on December 5, 2011. The Trust’s principal executive offices are located at 4221 North 203rd Street, Suite 100, Elkhorn, NE 68022. The Board of Trustees supervises the business activities of the Fund. Like other mutual funds, the Fund retains various organizations to perform specialized services. The Fund retains Dakota Wealth as investment adviser. Northern Lights Distributors, LLC, located at 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022, serves as principal underwriter and distributor of the Fund. Gemini Fund Services, LLC, with principal offices located at 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022, provides the Fund with transfer agent, accounting, compliance, and administrative services.

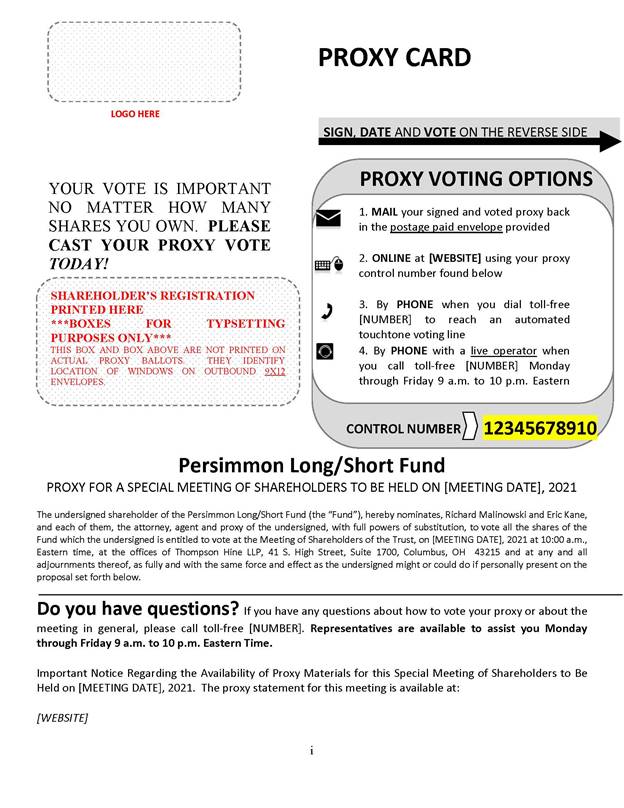

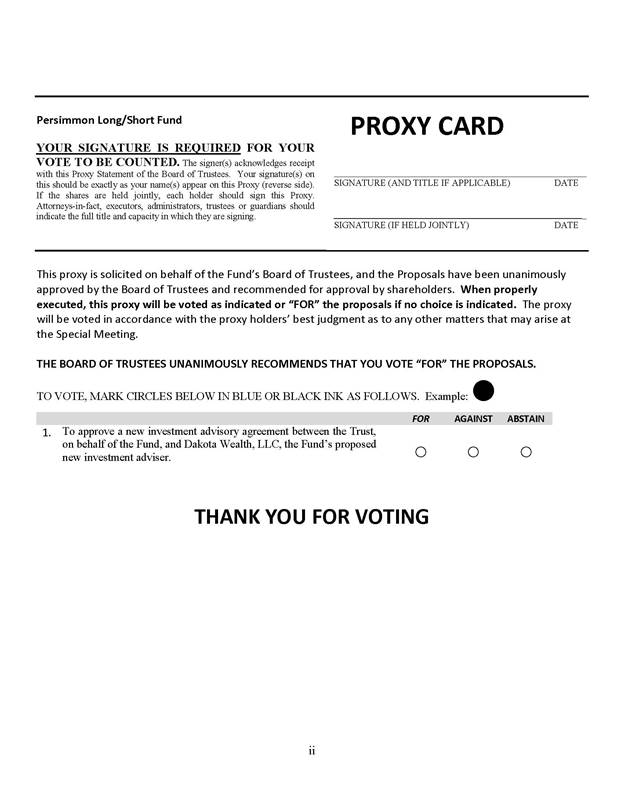

THE PROXY

The Board solicits proxies so that each shareholder has the opportunity to vote on the proposal to be considered at the Meeting. A proxy for voting your shares at the Meeting is enclosed. The shares represented by each valid proxy received in time will be voted at the meeting as specified. If no specification is made, the shares represented by a duly executed proxy will be voted for approval of the proposed New Advisory Agreement and at the discretion of the holders of the proxy on any other matter that may come before the meeting that the Trust did not have notice of a reasonable time prior to the mailing of this Proxy Statement. You may revoke your proxy at any time before it is exercised by (1) submitting a duly executed proxy bearing a later date, (2) submitting a written notice to the President of the Trust revoking the proxy, or (3) attending and voting in person at the Meeting.

VOTING SECURITIES AND VOTING

As of the Record Date, there were [INSERT NUMBER]3,161,943.1020 shares of beneficial interest of the Fund issued and outstanding.

All shareholders of record of the Fund on the Record Date are entitled to vote at the Meeting on the proposal to approve the proposed New Advisory Agreement. Each shareholder is entitled to one (1) vote per share held, and fractional votes for fractional shares held, on any matter submitted to a vote at the Meeting.

An affirmative vote of the holders of a “majority” of the outstanding shares of the Fund is required for the approval of the proposed New Advisory Agreement. As defined in the 1940 Act, a vote of the holders of a majority of the outstanding shares of the Fund means the vote of (1) 67% or more of the voting shares of the Fund present at the meeting, if the holders of more than 50% of the outstanding shares of the Fund are present in person or represented by proxy, or (2) more than 50% of the outstanding voting shares of the Fund, whichever is less.

Abstentions will be considered present for purposes of determining the existence of a quorum and the number of shares of the Fund represented at the meeting. As a result, with respect to the approval of the proposed New Advisory Agreement, abstentions will have the same effect as a vote against the proposal because the required vote is a percentage of the shares present or outstanding. Because broker-dealers (in the absence of specific authorization from their customers) do not have discretionary authority to vote shares held beneficially by their customers on the proposal to approve the New Advisory Agreement, there are unlikely to be any “broker non-votes” at the Meeting. “Broker non-votes” would otherwise have the same effect as abstentions (that is, they would be treated as if they were votes against the proposal). A signed proxy card received from a shareholder that does not specify how the shareholder’s shares should be voted on the proposal will be considered present for purposes of determining the existence of a quorum and the number of shares of the Fund represented at the meeting and will be deemed an instruction to vote such shares in favor of the proposal. An unsigned proxy card will not be considered present for purposes of determining the existence of a quorum and the number of shares of the Fund represented at the meeting, and they will not be considered an affirmative vote for any proposal.

Under the Trust’s Declaration of Trust, a quorum is constituted by the presence or by proxy of 331/3% of the outstanding shares entitled to vote at the Meeting. If a quorum is not present at the Meeting, or a quorum is present at the Meeting but sufficient votes to approve a proposal for the Fund are not received, the secretary of the Meeting or the holders of the majority of the shares of the Fund present at the Meeting in person or by proxy may adjourn the Meeting to permit further solicitation of proxies. At the Meeting, or any adjournment thereof, the persons named as proxies will vote in accordance with the shareholder instructions indicated on all properly executed and submitted proxy cards.

| 10 |

Security Ownership of Management AND Certain Beneficial Owners

As of the Record Date, the following shareholders of record owned 5% or more of the outstanding shares of the Fund:

| |||

| Name & Address | Shares | Percentage of Fund |

CHARLES SCHWAB & CO INC/SPECIAL CUSTODY A/C FBO CUSTOMERS ATTN: MUTUAL FUNDS 211 MAIN STREET SAN FRANCISCO, CA 94105 | 828,822.8250 | 26.21% |

PERSHING LLC P. O. BOX 2052 JERSEY CITY, NJ 07303-9998 | 442,908.5120 | 14.01% |

PERSHING LLC P. O. BOX 2052 JERSEY CITY, NJ 07303-9998 | 485,647.0200 | 15.36% |

PERSHING LLC P. O. BOX 2052 JERSEY CITY, NJ 07303-9998 | 351,615.6490 | 11.12% |

PERSHING LLC P. O. BOX 2052 JERSEY CITY, NJ 07303-9998 | 276,741.2780 | 8.75% |

Shareholders owning more than 25% of the outstanding shares of the Fund are considered to “control” the Fund, as that term is defined under the 1940 Act. Persons controlling the Fund may be able to determine the outcome of any proposal submitted to the shareholders for approval.

As a group, the Trustees and officers of the Trust owned less than 1% of the outstanding shares of the Fund as of the Record Date. As a result, the Trustees and officers as a group are not deemed to control the Fund.

| 11 |

SHAREHOLDER PROPOSALS

The Trust has not received any shareholder proposals to be considered for presentation at the Meeting. Under the proxy rules of the United States Securities and Exchange Commission, shareholder proposals may, under certain conditions, be included in the Trust’s Proxy Statement and proxy for a particular meeting. Under these rules, proposals submitted for inclusion in the Trust’s proxy materials must be received by the Trust within a reasonable time before the solicitation is made. The fact that the Trust receives a shareholder proposal in a timely manner does not ensure its inclusion in its proxy materials, because there are other requirements in the proxy rules relating to such inclusion. You should be aware that annual meetings of shareholders are not required as long as there is no particular requirement under the 1940 Act, which must be met by convening such a shareholder meeting. Any shareholder proposal should be sent to Eric Kane, Esq., Secretary, Northern Lights Fund Trust III, 80 Arkay Drive, Suite 110, Hauppauge, NY 11788.

COST OF SOLICITATION

The Board is making this solicitation of proxies. The Trust has engaged Broadridge Financial Solutions, Inc. (“Broadridge”), a proxy solicitation firm, to assist in the solicitation. The estimated fees anticipated to be paid to Broadridge are approximately $1,677. The cost of preparing and mailing this Proxy Statement, the accompanying Notice of Special Meeting and proxy and any additional materials relating to the meeting and the cost of soliciting proxies will be borne by Dakota Wealth. In addition to solicitation by mail, the Trust will request banks, brokers and other custodial nominees and fiduciaries to supply proxy materials to the respective beneficial owners of shares of the Fund of whom they have knowledge, and Dakota Wealth will reimburse them for their expenses in so doing. Certain officers, employees and agents of the Trust and Dakota Wealth may solicit proxies in person or by telephone, facsimile transmission, or mail, for which they will not receive any special compensation.

OTHER MATTERS

The Board knows of no other matters to be presented at the Meeting other than as set forth above. If any other matters properly come before the meeting that the Trust did not have notice of a reasonable time prior to the mailing of this Proxy Statement, the holders of the proxy will vote the shares represented by the proxy on such matters in accordance with their best judgment, and discretionary authority to do so is included in the proxy.

| 12 |

PROXY DELIVERY

If you and another shareholder share the same address, the Trust may only send one Proxy Statement unless you or the other shareholder(s) request otherwise. Call or write to the Trust if you wish to receive a separate copy of the Proxy Statement, and the Trust will promptly mail a copy to you. You may also call or write to the Trust if you wish to receive a separate proxy in the future or if you are receiving multiple copies now and wish to receive a single copy in the future. For such requests, call the Trust at 1-800-788-6086,1-855-233-8300, or write the Trust at 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022.

A copy of the Fund’s most recent annual report, including financial statements and schedules, is available at no charge by visiting www.persimmonfunds.com, sending a written request to the Fund, 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022 or by calling 1-855-233-8300.

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on [DATE],October 15, 2021

A copy of the Notice of Shareholder Meeting, the Proxy Statement, and Proxy Card are available at [INSERT WEBSITE].www.proxyvote.com.

BY ORDER OF THE BOARD OF TRUSTEES

/s/ Eric Kane

Eric Kane, Esq., Secretary

Dated: April [MAILING DATE],September 17, 2021

If you have any questions before you vote, please call our proxy information line at [INSERT TOLL FREE NUMBER]. Representatives are available Monday through Friday 9 a.m. to 10 p.m., Eastern Time to answer your questions about the proxy material or about how to how to cast your vote. You may also receive a telephone call reminding you to vote your shares. Thank you for your participation in this important initiative.

Please date and sign the enclosed proxy and return it promptly in the enclosed reply envelope or Call the number listed on your proxy card.

| A-2 |

Exhibit A

INVESTMENT ADVISORY AGREEMENT

Between

NORTHERN LIGHTS FUND TRUST III

and

DAKOTA WEALTH, LLC

[

This AGREEMENT is made as of June 17, 2021 between NORTHERN LIGHTS FUND TRUST III, a Delaware statutory trust (the “Trust”), and Dakota Wealth, LLC. a Florida Limited Liability Company (the “Adviser”) located at 11376 N. Jog Road, Palm Beach Gardens, FL 33418.

RECITALS:

WHEREAS, the Trust is an open-end management investment company and is registered as such under the Investment Company Act of 1940, as amended (the "Act");

WHEREAS, the Trust is authorized to issue shares of beneficial interest in separate series, each having its own investment objective or objectives, policies and limitations;

WHEREAS, the Trust offers shares in the series named on Appendix A hereto (each series being herein referred to as a “Fund” and, together with all other series subsequently established by the Trust and made subject to this Agreement in accordance with Section 1.3, as the "Fund");

WHEREAS, the Adviser is or soon will be registered as an investment adviser under the Investment Advisers Act of 1940; and

WHEREAS, the Trust desires to retain the Adviser to render investment advisory services to the Trust with respect to the Fund in the manner and on the terms and conditions hereinafter set forth;

NOW, THEREFORE, the parties hereto agree as follows:

1. Services of the Adviser.

1.1 Investment Advisory Services. The Adviser shall act as the investment adviser to the Fund and, as such, shall (i) obtain and evaluate such information relating to the economy, industries, business, securities markets and securities as it may deem necessary or useful in discharging its responsibilities hereunder, (ii) formulate a continuing program for the investment of the assets of the Fund in a manner consistent with its investment objective(s), policies and restrictions, and (iii) determine from time to time securities to be inserted]purchased, sold, retained or lent by the Fund, and implement those decisions, including the selection of entities with or through which such purchases, sales or loans are to be effected; provided, that the Adviser will place orders pursuant to its investment determinations either directly with the issuer or with a broker or dealer, and if with a broker or dealer, (a) will attempt to obtain the best price and execution of its orders, and (b) may nevertheless in its discretion purchase and sell portfolio securities from and to brokers who provide the Adviser with research, analysis, advice and similar services and pay such brokers in return a higher commission than may be charged by other brokers.

| A-3 |

The Trust hereby authorizes any entity or person associated with the Adviser or any sub-adviser retained by the Adviser pursuant to Section 9 of this Agreement, which is a member of a national securities exchange, to effect any transaction on the exchange for the account of the Trust which is permitted by Section 11(a) of the Securities Exchange Act of 1934 and Rule 11a2-2(T) thereunder, and the Trust hereby consents to the retention of compensation for such transactions in accordance with Rule 11a2-2(T)(a)(2)(iv) provided the transaction complies with the Trust’s Rule 17e-1 policies and procedures.

The Adviser shall carry out its duties with respect to the Fund's investments in accordance with applicable law and the investment objectives, policies and restrictions set forth in the Fund's then-current Prospectus and Statement of Additional Information, and subject to such further limitations as the Trust may from time to time impose by written notice to the Adviser.

1.2 Administrative Services. The Trust has engaged the services of an administrator. The Adviser shall provide such additional administrative services as reasonably requested by the Board of Trustees or officers of the Trust; provided, that the Adviser shall not have any obligation to provide under this Agreement any direct or indirect services to Trust shareholders, any services related to the distribution of Trust shares, or any other services which are the subject of a separate agreement or arrangement between the Trust and the Adviser. Subject to the foregoing, in providing administrative services hereunder, the Adviser shall:

1.2.1 Office Space, Equipment and Facilities. Provide such office space, office equipment and office facilities as are adequate to fulfill the Adviser’s obligations hereunder.

1.2.2 Personnel. Provide, without remuneration from or other cost to the Trust, the services of individuals competent to perform the administrative functions which are not performed by employees or other agents engaged by the Trust or by the Adviser acting in some other capacity pursuant to a separate agreement or arrangement with the Trust.

1.2.3 Agents. Assist the Trust in selecting and coordinating the activities of the other agents engaged by the Trust, including the Trust's shareholder servicing agent, custodian, administrator, independent auditors and legal counsel.

1.2.4 Trustees and Officers. Authorize and permit the Adviser's directors, officers and employees who may be elected or appointed as Trustees or officers of the Trust to serve in such capacities, without remuneration from or other cost to the Trust.

1.2.5 Books and Records. Assure that all financial, accounting and other records required to be maintained and preserved by the Adviser on behalf of the Trust are maintained and preserved by it in accordance with applicable laws and regulations.

1.2.6 Reports and Filings. Assist in the preparation of (but not pay for) all periodic reports by the Fund to its shareholders and all reports and filings required to maintain the registration and qualification of the Fund and Fund shares, or to meet other regulatory or tax requirements applicable to the Fund, under federal and state securities and tax laws.

1.3 Additional Series. In the event that the Trust establishes one or more series after the effectiveness of this Agreement ("Additional Series"), Appendix A to this Agreement may be amended to make such Additional Series subject to this Agreement upon the approval of the Board of Trustees of the Trust and the shareholder(s) of the Additional Series, in accordance with the provisions of the Act. The Trust or the Adviser may elect not to make any such series subject to this Agreement.

1.4 Change in Management or Control. The Adviser shall provide at least sixty (60) days' prior written notice to the Trust of any change in the ownership or management of the Adviser, or any event or action that may constitute a change in “control,” as that term is defined in Section 2 of the Act. The Adviser shall provide prompt notice of any change in the portfolio manager(s) responsible for the day-to-day management of the Fund.

2. Expenses of the Fund.

2.1 Expenses to be Paid by Adviser. The Adviser shall pay all salaries, expenses and fees of the officers, Trustees and employees of the Trust who are officers, directors, members or employees of the Adviser.

In the event that the Adviser pays or assumes any expenses of the Trust not required to be paid or assumed by the Adviser under this Agreement, the Adviser shall not be obligated hereby to pay or assume the same or any similar expense in the future; provided, that nothing herein contained shall be deemed to relieve the Adviser of any obligation to the Fund under any separate agreement or arrangement between the parties.

2.2 Expenses to be Paid by the Fund. The Fund shall bear all expenses of its operation, except those specifically allocated to the Adviser under this Agreement or under any separate agreement between the Trust and the Adviser. Subject to any separate agreement or arrangement between the Trust and the Adviser, the expenses hereby allocated to the Fund, and not to the Adviser, include but are not limited to:

2.2.1 Custody. All charges of depositories, custodians, and other agents for the transfer, receipt, safekeeping, and servicing of the Fund's cash, securities, and other property.

2.2.2 Shareholder Servicing. All expenses of maintaining and servicing shareholder accounts, including but not limited to the charges of any shareholder servicing agent, dividend disbursing agent, transfer agent or other agent engaged by the Trust to service shareholder accounts.

2.2.3 Shareholder Reports. All expenses of preparing, setting in type, printing and distributing reports and other communications to shareholders.

2.2.4 Prospectuses. All expenses of preparing, converting to EDGAR format, filing with the Securities and Exchange Commission or other appropriate regulatory body, setting in type, printing and mailing annual or more frequent revisions of the Fund's Prospectus and Statement of Additional Information and any supplements thereto and of supplying them to shareholders.

2.2.5 Pricing and Portfolio Valuation. All expenses of computing the Fund's net asset value per share, including any equipment or services obtained for the purpose of pricing shares or valuing the Fund's investment portfolio.

2.2.6 Communications. All charges for equipment or services used for communications between the Adviser or the Trust and any custodian, shareholder servicing agent, portfolio accounting services agent, or other agent engaged by the Trust.

2.2.7 Legal and Accounting Fees. All charges for services and expenses of the Trust's legal counsel and independent accountants.

2.2.8 Trustees' Fees and Expenses. All compensation of Trustees other than those affiliated with the Adviser, all expenses incurred in connection with such unaffiliated Trustees' services as Trustees, and all other expenses of meetings of the Trustees and committees of the Trustees.

2.2.9 Shareholder Meetings. All expenses incidental to holding meetings of shareholders, including the printing of notices and proxy materials, and proxy solicitations therefor.

2.2.10 Federal Registration Fees. All fees and expenses of registering and maintaining the registration of the Fund under the Act and the registration of the Fund's shares under the Securities Act of 1933 (the "1933 Act"), including all fees and expenses incurred in connection with the preparation, converting to EDGAR format, setting in type, printing, and filing of any Registration Statement, Prospectus and Statement of Additional Information under the 1933 Act or the Act, and any amendments or supplements that may be made from time to time.

2.2.11 State Registration Fees. All fees and expenses of taking required action to permit the offer and sale of the Fund's shares under securities laws of various states or jurisdictions, and of registration and qualification of the Fund under all other laws applicable to the Trust or its business activities (including registering the Trust as a broker-dealer, or any officer of the Trust or any person as agent or salesperson of the Trust in any state).

2.2.12 Confirmations. All expenses incurred in connection with the issue and transfer of Fund shares, including the expenses of confirming all share transactions.

2.2.13 Bonding and Insurance. All expenses of bond, liability, and other insurance coverage required by law or regulation or deemed advisable by the Trustees of the Trust, including, without limitation, such bond, liability and other insurance expenses that may from time to time be allocated to the Fund in a manner approved by its Trustees.

2.2.14 Brokerage Commissions. All brokers' commissions and other charges incident to the purchase, sale or lending of the Fund's portfolio securities.

2.2.15 Taxes. All taxes or governmental fees payable by or with respect to the Fund to federal, state or other governmental agencies, domestic or foreign, including stamp or other transfer taxes.

2.2.16 Trade Association Fees. All fees, dues and other expenses incurred in connection with the Trust's membership in any trade association or other investment organization.

2.2.18 Compliance Fees. All charges for services and expenses of the Trust's Chief Compliance Officer.

2.2.19 Nonrecurring and Extraordinary Expenses. Such nonrecurring and extraordinary expenses as may arise including the costs of actions, suits, or proceedings to which the Trust is a party and the expenses the Trust may incur as a result of its legal obligation to provide indemnification to its officers, Trustees and agents.

3. Advisory Fee.

As compensation for all services rendered, facilities provided and expenses paid or assumed by the Adviser under this Agreement, the Fund shall pay the Adviser on the last day of each month, or as promptly as possible thereafter, a fee calculated by applying a monthly rate, based on an annual percentage rate, to the Fund's average daily net assets for the month. The annual percentage rate applicable to the Fund is set forth in Appendix A to this Agreement, as it may be amended from time to time in accordance with Section 1.3 of this Agreement. If this Agreement shall be effective for only a portion of a month with respect to the Fund, the aforesaid fee shall be prorated for the portion of such month during which this Agreement is in effect for the Fund.

4. Proxy Voting.

The Adviser will vote, or make arrangements to have voted, all proxies solicited by or with respect to the issuers of securities in which assets of the Fund may be invested from time to time. Such proxies will be voted in a manner that the Adviser deems, in good faith, to be in the best interest of the Fund and in accordance with the Adviser’s proxy voting policy. The Adviser agrees to provide a copy of its proxy voting policy to the Trust prior to the execution of this Agreement, and any amendments thereto promptly.

5. Records.

5.1 Tax Treatment. Both the Adviser and the Trust shall maintain, or arrange for others to maintain, the books and records of the Trust in such a manner that treats the Fund as a separate entity for federal income tax purposes.

5.2 Ownership. All records required to be maintained and preserved by the Trust pursuant to the provisions or rules or regulations of the Securities and Exchange Commission under Section 31(a) of the Act and maintained and preserved by the Adviser on behalf of the Trust are the property of the Trust and shall be surrendered by the Adviser promptly on request by the Trust; provided, that the Adviser may at its own expense make and retain copies of any such records.

6. Reports to Adviser.

The Trust shall furnish or otherwise make available to the Adviser such copies of the Fund's Prospectus, Statement of Additional Information, financial statements, proxy statements, reports and other information relating to its business and affairs as the Adviser may, at any time or from time to time, reasonably require in order to discharge its obligations under this Agreement.

7. Reports to the Trust.

The Adviser shall prepare and furnish to the Trust such reports, statistical data and other information in such form and at such intervals as the Trust may reasonably request.

8. Code of Ethics.

The Adviser has adopted a written code of ethics complying with the requirements of Rule 17j-1 under the Act and will provide the Trust with a copy of the code and evidence of its adoption. The Adviser will provide to the Board of Trustees of the Trust at least annually a written report that describes any issues arising under the code of ethics since the last report to the Board of Trustees, including, but not limited to, information about material violations of the code and sanctions imposed in response to the material violations; and which certifies that the Adviser has adopted procedures reasonably necessary to prevent "access persons" (as that term is defined in Rule 17j-1) from violating the code.

9. Retention of Sub-Adviser.

Subject to the Trust's obtaining the initial and periodic approvals required under Section 15 of the Act, the Adviser may retain one or more sub-advisers, at the Adviser's own cost and expense, for the purpose of managing the investments of the assets of the Fund. Retention of one or more sub-advisers shall in no way reduce the responsibilities or obligations of the Adviser under this Agreement and the Adviser shall, subject to Section 11 of this Agreement, be responsible to the Trust for all acts or omissions of any sub-adviser in connection with the performance of the Adviser's duties hereunder.

10. Services to Other Clients.

Nothing herein contained shall limit the freedom of the Adviser or any affiliated person of the Adviser to render investment management and administrative services to other investment companies, to act as investment adviser or investment counselor to other persons, firms or corporations, or to engage in other business activities.

11. Limitation of Liability of Adviser and its Personnel.

Neither the Adviser nor any director, manager, officer or employee of the Adviser performing services for the Trust at the direction or request of the Adviser in connection with the Adviser's discharge of its obligations hereunder shall be liable for any error of judgment or mistake of law or for any loss suffered by the Trust in connection with any matter to which this Agreement relates, and the Adviser shall not be responsible for any action of the Trustees of the Trust in following or declining to follow any advice or recommendation of the Adviser or any sub-adviser retained by the Adviser pursuant to Section 9 of this Agreement; PROVIDED, that nothing herein contained shall be construed (i) to protect the Adviser against any liability to the Trust or its shareholders to which the Adviser would otherwise be subject by reason of willful misfeasance, bad faith, or gross negligence in the performance of the Adviser's duties, or by reason of the Adviser's reckless disregard of its obligations and duties under this Agreement, or (ii) to protect any director, manager, officer or employee of the Adviser who is or was a Trustee or officer of the Trust against any liability of the Trust or its shareholders to which such person would otherwise be subject by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person's office with the Trust.

12. Effect of Agreement.

Nothing herein contained shall be deemed to require to the Trust to take any action contrary to its Declaration of Trust or its By-Laws or any applicable law, regulation or order to which it is subject or by which it is bound, or to relieve or deprive the Trustees of the Trust of their responsibility for and control of the conduct of the business and affairs of the Trust.

13. Term of Agreement.

With respect to the Fund, the term of this Agreement shall begin as of the date and year upon which the Fund’s shareholders approve the Agreement, and unless sooner terminated as hereinafter provided, this Agreement shall remain in effect for a period of two years. Thereafter, this Agreement shall continue in effect with respect to the Fund from year to year, subject to the termination provisions and all other terms and conditions hereof; PROVIDED, such continuance with respect to the Fund is approved at least annually by vote of the holders of a majority of the outstanding voting securities of the Fund or by the Trustees of the Trust; PROVIDED, that in either event such continuance is also approved annually by the vote, cast in person at a meeting called for the purpose of voting on such approval, of a majority of the Trustees of the Trust who are not parties to this Agreement or interested persons of either party hereto. The Adviser shall furnish to the Trust, promptly upon its request, such information as may reasonably be necessary to evaluate the terms of this Agreement or any extension, renewal or amendment thereof.

14. Amendment or Assignment of Agreement.

Any amendment to this Agreement shall be in writing signed by the parties hereto; PROVIDED, that no such amendment shall be effective unless authorized (i) by resolution of the Trustees of the Trust, including the vote or written consent of a majority of the Trustees of the Trust who are not parties to this Agreement or interested persons of either party hereto, and (ii) by vote of a majority of the outstanding voting securities of the Fund affected by such amendment if required by applicable law. This Agreement shall terminate automatically and immediately in the event of its assignment.

15. Termination of Agreement.

This Agreement may be terminated as to the Fund at any time by either party hereto, without the payment of any penalty, upon sixty (60) days' prior written notice to the other party; PROVIDED, that in the case of termination by the Fund, such action shall have been authorized (i) by resolution of the Trust's Board of Trustees, including the vote or written consent of Trustees of the Trust who are not parties to this Agreement or interested persons of either party hereto, or (ii) by vote of majority of the outstanding voting securities of the Fund.

16. Use of Name.

The Trust is named the Northern Lights Fund Trust III and the Fund may be identified, in part, by the name "Northern Lights."

17. Declaration of Trust.

The Adviser is hereby expressly put on notice of the limitation of shareholder liability as set forth in the Trust's Declaration of Trust and agrees that the obligations assumed by the Trust or the Fund, as the case may be, pursuant to this Agreement shall be limited in all cases to the Trust or the Fund, as the case may be, and its assets, and the Adviser shall not seek satisfaction of any such obligation from the shareholders or any shareholder of the Trust. In addition, the Adviser shall not seek satisfaction of any such obligations from the Trustees or any individual Trustee. The Adviser understands that the rights and obligations of the Fund under the Declaration of Trust are separate and distinct from those of any and all other funds. The Adviser further understands and agrees that no fund of the Trust shall be liable for any claims against any other fund of the Trust and that the Adviser must look solely to the assets of the pertinent fund of the Trust for the enforcement or satisfaction of any claims against the Trust with respect to that fund.

| A-10 |

18. Confidentiality.

The Adviser agrees to treat all records and other information relating to the Trust and the securities holdings of the Fund as confidential and shall not disclose any such records or information to any other person unless (i) the Board of Trustees of the Trust has approved the disclosure or (ii) such disclosure is compelled by law. In addition, the Adviser and the Adviser's officers, directors, members and employees are prohibited from receiving compensation or other consideration, for themselves or on behalf of the Fund, as a result of disclosing the Fund's portfolio holdings. The Adviser agrees that, consistent with the Adviser's Code of Ethics, neither the Adviser nor the Adviser's officers, directors, members or employees may engage in personal securities transactions based on nonpublic information about the Fund's portfolio holdings.

19. Governing Law.

This Agreement shall be governed and construed in accordance with the laws of the State of New York.

20. Interpretation and Definition of Terms.

Any question of interpretation of any term or provision of this Agreement having a counterpart in or otherwise derived from a term or provision of the Act shall be resolved by reference to such term or provision of the Act and to interpretation thereof, if any, by the United States courts, or, in the absence of any controlling decision of any such court, by rules, regulations or orders of the Securities and Exchange Commission validly issued pursuant to the Act. Specifically, the terms "vote of a majority of the outstanding voting securities," "interested persons," "assignment" and "affiliated person," as used in this Agreement shall have the meanings assigned to them by Section 2(a) of the Act. In addition, when the effect of a requirement of the Act reflected in any provision of this Agreement is modified, interpreted or relaxed by a rule, regulation or order of the Securities and Exchange Commission, whether of special or of general application, such provision shall be deemed to incorporate the effect of such rule, regulation or order.

21. Captions.

The captions in this Agreement are included for convenience of reference only and in no way define or delineate any of the provisions hereof or otherwise affect their construction or effect.

22. Execution in Counterparts.

This Agreement may be executed simultaneously in counterparts, each of which shall be deemed an original, but both of which together shall constitute one and the same instrument.

[Signature Page Follows]

| A-11 |

IN WITNESS WHEREOF, the parties have caused this Agreement to be signed by their respective officers thereunto duly authorized as of the date and year first above written.

NORTHERN LIGHTS FUND TRUST III

By:

Name: Richard Malinowski

Title: President

DAKOTA WEALTH, LLC

By:

Name:

Title:

| A-12 |

NORTHERN LIGHTS FUND TRUST III

INVESTMENT ADVISORY AGREEMENT

APPENDIX A

FUNDS OF THE TRUST

NAME OF FUND | ANNUAL ADVISORY FEE AS A PERCENTAGE OF AVERAGE NET ASSETS OF THE FUND |

| Persimmon Long/Short Fund | 1.25% |